How do NBFCs help students in India afford the best in education?

Earlier, we only had the banks to turn to whenever we needed a loan. However, with the emergence of NBFCs (Non-Banking Financial Companies), this is not the case anymore. With an academic screening of students, NBFCs have successfully managed to redefine the norms of lending student loans.

Let us take a look into the details of how NBFCs are playing a major role in helping students grab the best of educational opportunities:

1. No limitations on the coverage

When students apply for education loans from the banks, they get loans that cover specific expenses. These expenses are only restricted to academics. This is however not the case with NBFCs. When you apply for an education loan from an NBFC, there is no limitation on the loan coverage. This means that your education loan would cover both academic expenses such as the tuition fee, study material expenses, lab fees, etc. as well as non-academic expenses such as travelling costs, rent, food expenses, and so on.

2. No collateral required

This is one of the biggest benefits of applying for an education loan from an NBFC. Most financial institutions will make it mandatory for you to provide collateral as security if you are looking to borrow a loan amount that is more than Rs.7.5 lakhs. However, if you opt for an NBFC, you can get a much higher education loan amount without having to provide any collateral as security. With a bigger amount, you can aim to study at one of the top universities in the world without having to worry about finances.

3. No margin money required

For those who are unfamiliar with margin money, this is the money that you have to pay yourself for your expenses. Most banks set the margin money between a range of 5-15% of the loan amount, depending on whether you are pursuing your course in India or abroad. However, with an NBFC, you can get 100% financing as many NBFCs do not have any margin money requirements.

4. Flexible repayment options

Once students complete their graduation, they might not find a high-paying job the next day itself. NBFCs understand this and hence provide flexible repayment options. You can opt for a short or long tenure based on your preference. You can also opt for step-up EMIs. With step-up EMIs, your monthly installments will start in small amounts and gradually increase as the year’s pass. This helps you in stabilizing your finances while paying your education loan.

So, these are some of the best features of NBFCs, which is why so many students prefer them when it comes to applying for education loans. So, if you are ever in need of a good education loan plan, feel free to get in touch with us at Avanse. We offer customizable education loans with flexible repayment options. Do get in touch if you ever need any assistance, all the best!

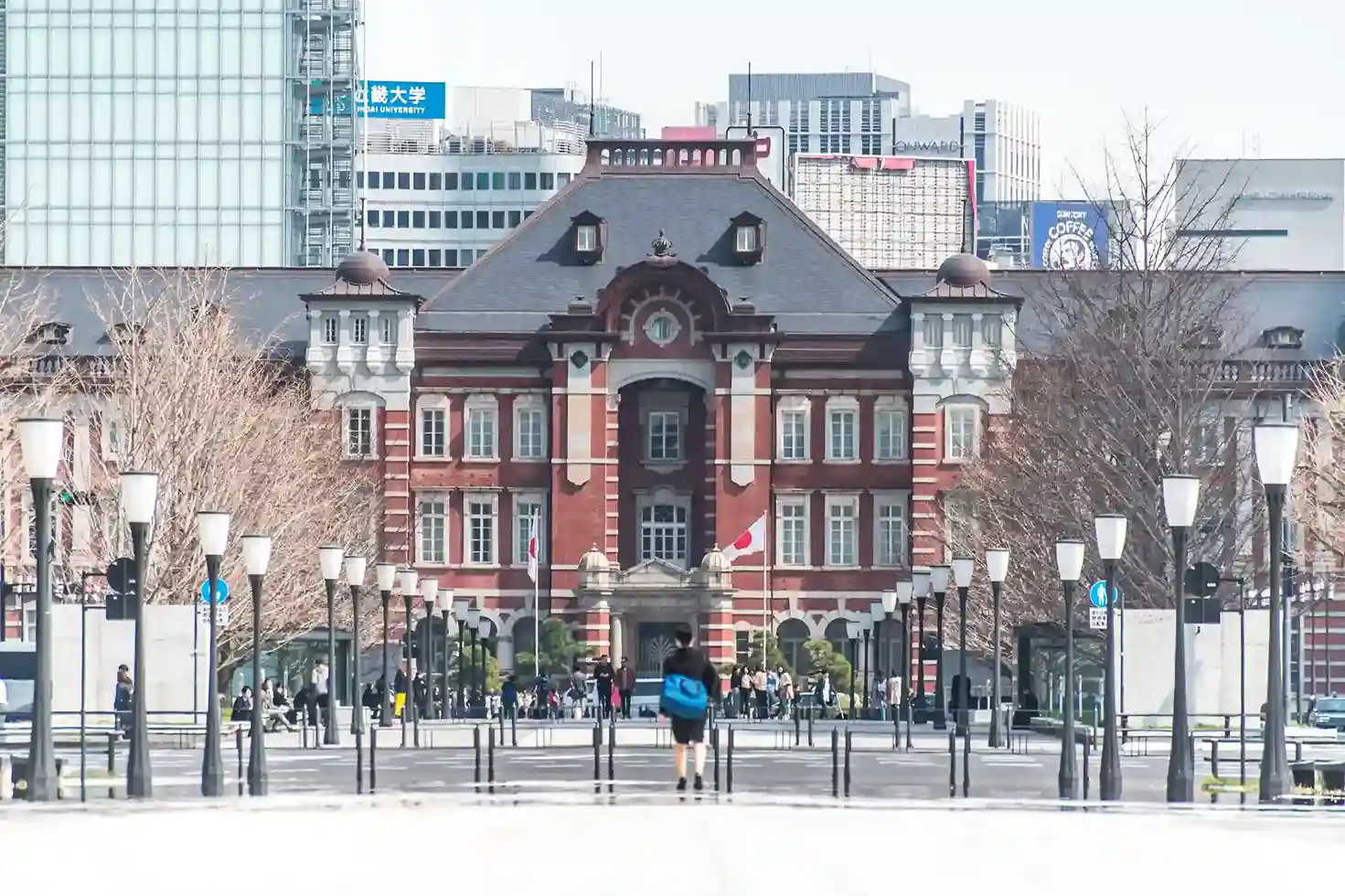

Wanting to study abroad

but stuck on finances?

Avanse will help overcome obstacles.

We always aim to offer you competitive interest rates on your Avanse Education loan.

The rate of interest on your loan is calculated as: Interest Rate = Avanse Base Rate +

Spread.

Our current Base Rate is 14.55% (WEF 01.12.2024).

The Spread is floating and is based on analysis of overall credit and course profiling.

- Rate of interest on student loan will be floating in nature.

- Interest is calculated using Simple Interest Rate with Monthly rest.

This rate is subject to the terms and conditions of Avanse Financial Services Ltd.

.png)