Hyper-personalised financial solutions that power your education!

Moving abroad for your higher education opens several doors. You can gain access to highly-acclaimed and globally recognised programmes, or you may enhance your career prospects for the future. We have designed a study abroad loan for students who aspire to pursue their overseas education. With a study abroad loan, you can achieve all your academic aspirations with ease! We offer a student loan without collateral and with collateral, depending on your student loan requirements.

100% Financing

Flexible Repayments

Quick Sanctions

Customisable Loans

India has been a hub of knowledge and learning since the 5th century, when institutes like the Nalanda University attracted scholars from around the world. Today, India is home to over 1,000 universities! When you get an Avanse student loan to study in India, you can fund your higher education in some of the world’s best-known institutes!

100% Financing

Flexible Repayments

Quick Sanctions

Customisable Loans

Avanse Offerings

At Avanse, we don’t just fuel academic aspirations, we help build India’s educational landscape. We provide loans for students, adult learners or educational institutes in need of educational finance. Here’s a look at our other education loan offerings:

Education Loan

With an Avanse education loan, you can focus on your course in the institute of your dreams and we'll take care of all the finances.

Read MoreEducation Institution Loan

We provide education finance in India to institutions aiming to grow their reach and educate as many students as possible. Our education loans can be used to build infrastructure, update technology or even purchase land for educational institutions.

Read MoreExecutive Education Loan

We provide executive education loans for professionals looking to grow and climb the corporate ladder. We offer special education loans for working professionals in India, including education loans for MBA.

Read More

E-Tutoring Loans

Help your child get the online help they need without breaking the bank. Get an education loan to fund your child’s online classes with Avanse!

Read MoreSkill Enhancement

Take your career to the next level with a skill enhancement loan. Get the skills you need to up your game with Avanse’s study loan for students.

Read MoreSchool Fee Financing

Never worry about paying your child’s school fees again! With Avanse, you can get the funds you need to pay the fees upfront and secure your child’s seat.

Read MoreWhy Choose Avanse Students Loan

Get up to 100% Financing

We provide education financing solutions that cover the holistic cost of education.

Flexible Repayment Options

You decide how and when you’d like to pay your loan back. You don’t have to make any payments until after you complete your course or secure employment!

Instant Loan for Students

With a fast-track student loan application, you can get the funds within 3 working days!

Customisable Loans

We design education financing solutions to suit your financial requirements.

Doorstep Service

If you need help with your student loan, we’ll send an executive to help you get through the paperwork. All you have to do is apply for online student loan.

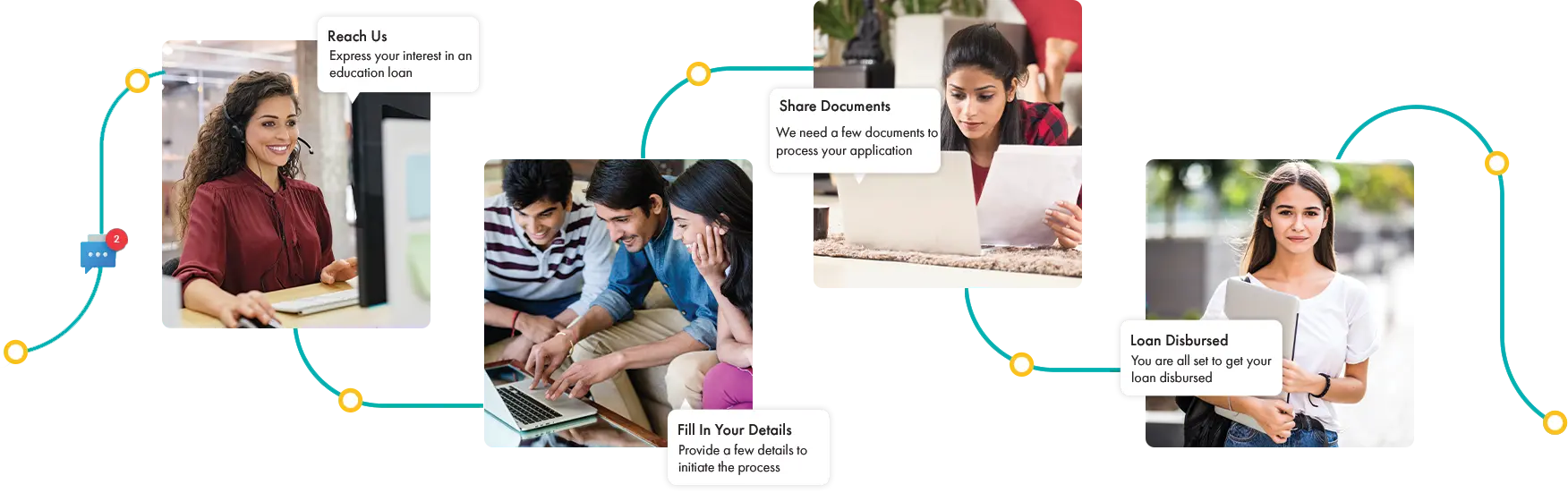

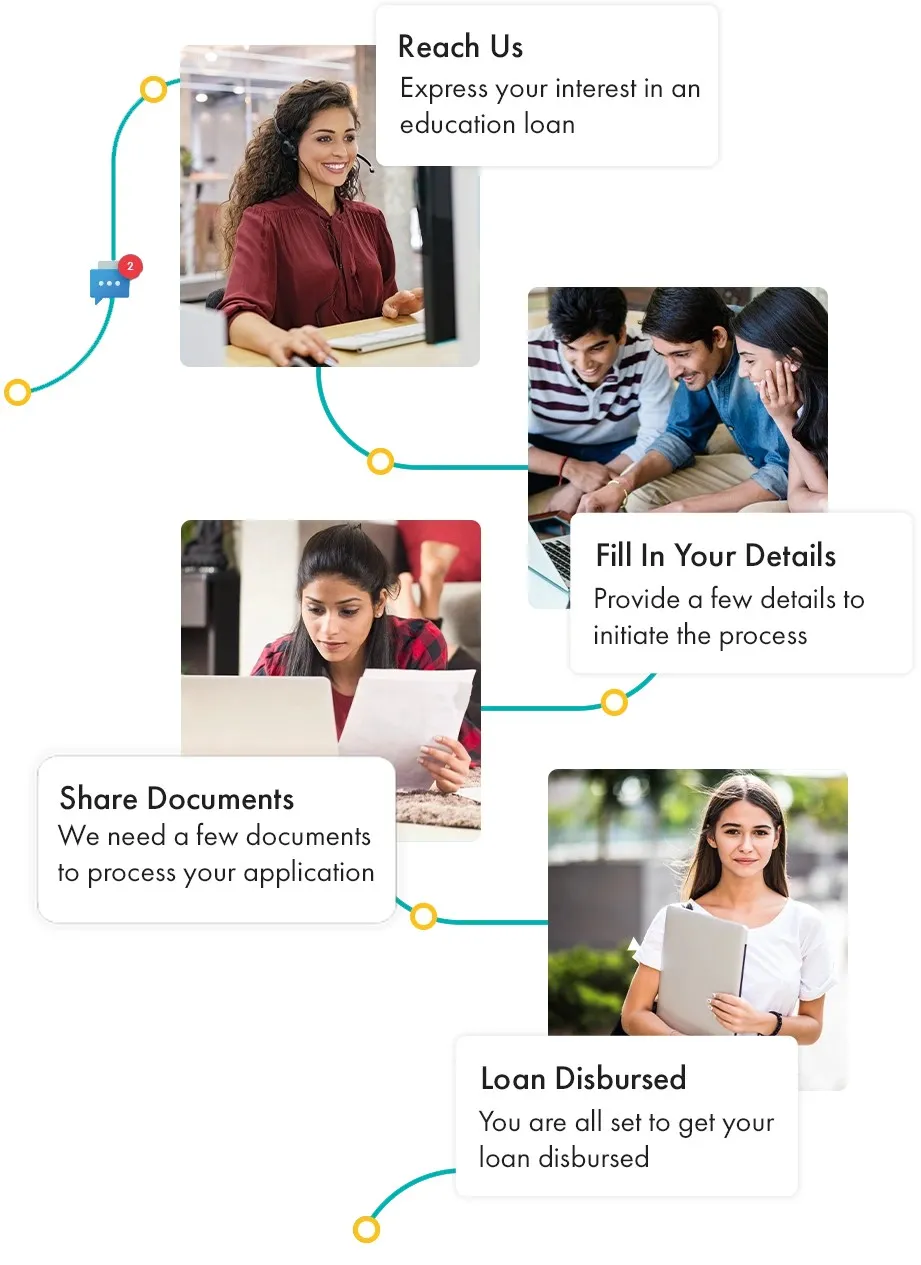

How to Get Education Loans for Students?

You shouldn’t have to jump through multiple hoops to apply for a student loan. The Avanse process is quick and simple.

We give you all the information you need to get your student loan application in order. To apply for an Avanse student loan

all you have to do is follow 4 easy steps.

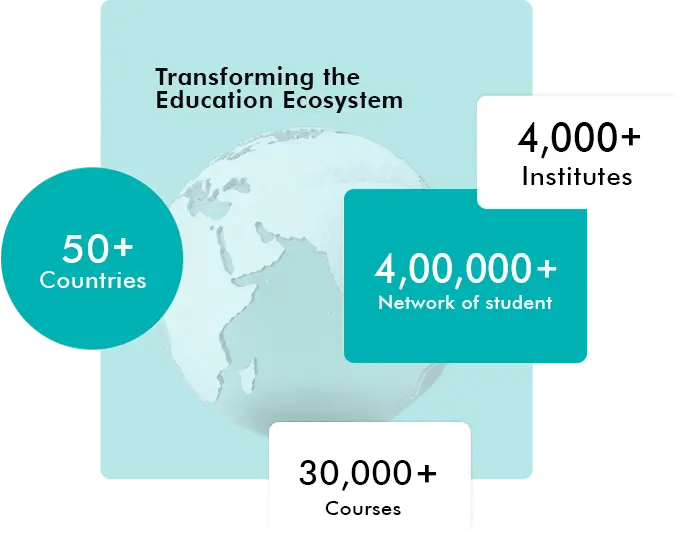

the Education Ecosystem

Since our inception, we have helped 4,00,000+ students realise their academic aspirations in 4000+ institutions across 50+ countries!

Apply Now

Student Success Stories

Read about the success stories of students who have achieved their educational aspiration.

Have a look at some of our achievements! We’re proud to count the

following awards

and certifications among our achievements.