Students Speak – How to create an appealing Statement of Purpose to gain a leading edge? Let’s learn from Ashutosh Borkar Part III

In the last episode, we covered Ashutosh Borkar’s

research mechanism and entrance exam. In this episode, we will cover

information about SOP, his future plans and how he found a perfect education

loan partner.

Key highlights

·

What study abroad

students must know about Statement of Purpose (SOP)

·

His future plans

·

How did his search

for the perfect student loan partner direct him to Avanse

Financial Services?

o

Research

o

His experience

What study

abroad students must know about Statement of Purpose (SOP)

SOP is an essay that captures your academic journey

and why you seek admission into a specific university. Ashutosh included his

qualifications, project work, work experience and all the relevant information

that showcased his talent, skills and motivation to pursue higher education at

the University of Michigan. He also stressed sending an error-free SOP, so

ensure you check the spelling mistakes and grammar before finalising it.

The SOP should be engaging as several students will be

applying along with you, and you need to stand out. The moderator will also

analyse if your previous program aligns with your chosen course and if you

possess the basic skills. There is a word limit that you must bear in mind when

drafting SOP. Depending on the university, the SOP can be 1,000-1,500 words

long.

·

Things to include in

the SOP

o

Inspiration to pursue

your preferred study program

o

Academic

qualifications and achievements

o

Projects/practicals

o

Publications (if any)

o

Extra-curricular

activities

o

Certification

programs

o

Work experience (if

any)

o

Reasons to choose

your university and destination

o

Short-term and

long-term goals

o

Career aspirations

His future plans

His smart plan is to gain work experience in the US and

pay off his student loan, as Ashutosh is confident about enormous opportunities

in the US market. Therefore, he has decided to work abroad, gain some

experience, pay off his education loan

and then return to his home country. This will work in his favour as he can

repay the study loan while building his successful career.

How did his

search for the perfect student loan partner direct him to Avanse Financial

Services?

·

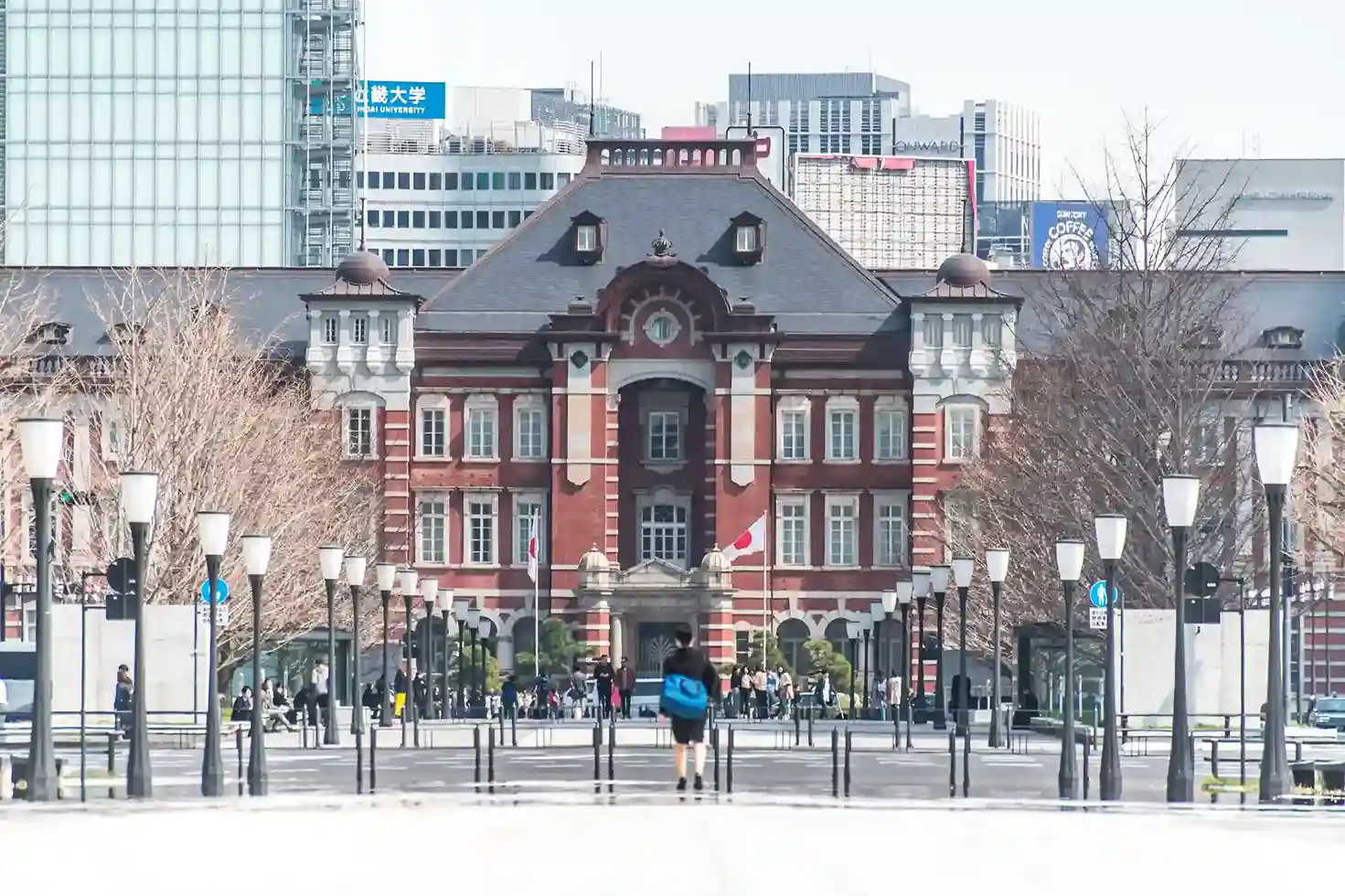

Research: Ashutosh

quickly required a sanction letter for an education loan for the visa process.

Secondly, keeping his preferences and financial requirement in mind, he chose

an unsecured loan (without collateral) over a secured loan (with collateral).

He researched online to find a lender that offered unsecured student loans with

quick sanctions. He shortlisted a few financial institutions, including Avanse

Financial Services, and shared his contact details to receive calls. One of his

friends had taken a study loan from Avanse, who shared his positive experience

with Ashutosh.

·

His experience: Ashutosh

shared that he had a hassle-free education loan journey. The team educated him

about the documentation procedure and answered all his doubts. The transparent

process further boosted his confidence. The quick sanction assisted him in

providing proof of funds to the visa authorities, which quickened his visa

approval.

So, in this episode, we covered interesting

information about the Statement of Purpose (SOP), his future plans, and how his

search for the perfect student loan partner directed him to Avanse Financial

Services. In the next episode, we will cover his student visa experience and

valuable advice for study abroad students. Meanwhile, if you have any doubts,

please share them with us. We will be glad to answer them all.

Wanting to study abroad

but stuck on finances?

Avanse will help overcome obstacles.

We always aim to offer you competitive interest rates on your Avanse Education loan.

The rate of interest on your loan is calculated as: Interest Rate = Avanse Base Rate +

Spread.

Our current Base Rate is 14.55% (WEF 01.12.2024).

The Spread is floating and is based on analysis of overall credit and course profiling.

- Rate of interest on student loan will be floating in nature.

- Interest is calculated using Simple Interest Rate with Monthly rest.

This rate is subject to the terms and conditions of Avanse Financial Services Ltd.