Avanse Swalaksh: Empowering Women Through Education

Exclusive education financing for women aiming to study abroad

0.25% concession on interest rates*

Flat processing fee of ₹10,000*

Exclusive rewards for academic excellence*

At Avanse, we believe every woman deserves the opportunity to chase her academic dreams without financial worries. Swalaksh, our exclusive education loan for women, is designed to make your overseas education journey smoother and more rewarding.

Lower Interest Rates

Enjoy a 0.25% concession on your loan interest*

Flat Processing Fee

Pay a processing fee of ₹10,000*

Academic Performance Benefits

Receive benefits of ₹10,000 if your latest academic score is above 80%*

Performance-Based Rewards

Earn benefits of ₹10,000 by achieving a CGPA >3.5 in the funded course*

Smart Savings

Get your last 12 EMIs waived, making repayments easier*

Female students pursuing their higher education dreams abroad are eligible to apply for a Swalaksh Education Loan from Avanse Financial Services Limited.

Let Swalaksh take care of your financial needs so you can focus on what truly matters-your future.

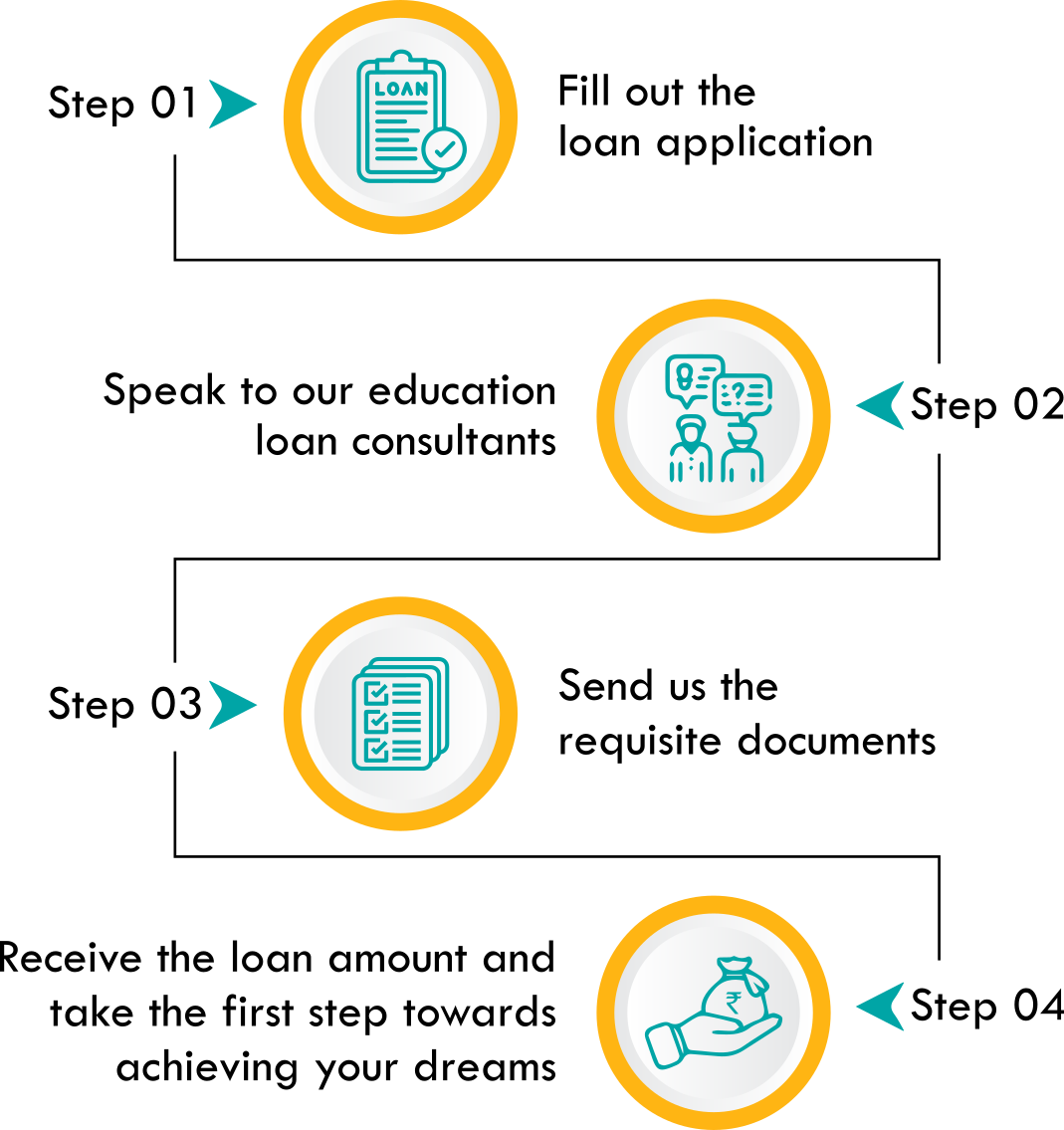

Here’s how you can get your Swalaksh Education Loan application started:

-

Eligibility Criteria

Young girls can apply if they:

- Are Indian citizens who are 18 or older

- Have a confirmed admission before the final disbursal

- Have a co-borrower who earns in India

Co-borrowers also need to meet the following criteria:

- Must be an Indian citizen and should be a parent, legal guardian, sibling or other blood relative

- Must have a bank account in India that allows them to sign cheques

- Must be the primary debtor

Women can apply for an overseas education loan for graduate or post-graduate courses or other job-oriented professional or technical courses. The courses and the institute offering them must be approved by Avanse.

-

Documentation Required

To complete your application, you will also have to provide the following documents:

- Student KYC and educational documents

- Details regarding the course and fees

- Co-borrower KYC and income details

- Collateral documents

Here’s a look at our document checklist to help you prepare:

Documents Applicant Co-Applicant Additional Co-Applicant Guarantor 2 Colour Passport-sized Photos Photo ID Residence Proof Date of Birth Proof Signature Verification Academic Documents Proof of Admission Fee Structure Income Proof Collateral Documents 8-month Bank Statement Relationship Proof -

Loan Amounts

At Avanse, we don’t want to limit your dreams. While the minimum loan amount is ₹10,00,000, we do not put a cap on the maximum loan amount. We strive to create customised education loans that meet all your financial needs with ease. Additionally, we will not ask for any margin contribution. Our goal is to provide holistic funding for every woman’s higher education abroad, enabling young girls to achieve their academic aspirations successfully

-

Loan Coverage

Our education loan will cover:

- Up to 100% of the tuition fee as decided by the university or institute

- Up to 75% of your living expenses, including the purchase of books, computers and other equipment, as long as it does not exceed 20% of the tuition fee

- Up to 100% of the building fund or caution deposit or refundable deposit as long as it does not exceed 10% of the tuition fee and comes with valid bills or receipts from the institution

-

The Loan Process

When you choose Avanse as your education financing partner, you can count on quick, transparent and completely hassle-free loans. To apply for a Swalaksh Education Loan, you can fill up the online form or send an email to wecare@avanse.com. For a smooth application journey, you should inform us about:

- The amount of financial assistance required

- The course and institute where you intend to study

- The identity of your co-applicant or guarantor

Ideally, check which documents you need to submit and apply for the loan well in advance to avoid last-minute hassles.

Once we receive the application, our consultants will review it and get in touch with you if they require any additional information. If your application checks all our boxes, we will provide you with a formal Loan Offer letter. Here, we outline the loan amount you can get as well as a list of documents we require from you. You may use the loan offer letter to secure your seat at your preferred university or institute.

Once all the paperwork is ready, we will provide you with an education loans agreement. The agreement lists out all the terms and conditions. After you review the paperwork and sign it, we will disburse the loan amount via DD, cheque or electronic transfer

-

Loan Security

Avanse provides secured educational loans for women pursuing their higher education journeys abroad. The collateral we accept as security includes:

- Residential property (apartment/house)

- Fixed deposit by any registered deposit-taking organisation, assigned in favour of Avanse

- Life insurance with a surrender value equal to the required security coverage

- Non-agricultural land

-

Loan Processing Fee

Flat processing fee of ₹10,000 for all women study abroad applicants.

-

Repayment Options

Our loans are designed to help you meet all your financial needs. So, we provide multiple repayment options. You can start repaying from the time you’re in college or once you complete the course and secure a job. While repaying, you can choose between:

- Interest servicing during the course

- Partial interest servicing during the course

- EMI repayment during the course

- EMI repayment after a holiday/moratorium period

- Step up repayment facility

- Processing fees of ₹10,000 (+GST as applicable) must be paid to avail the Swalaksh product benefits.

- Students shall provide official academic transcripts or mark sheets as proof of their scores. The submitted academic records shall be reviewed and verified by the Company.

- The Company reserves the right to reject any application if the documents are found to be incomplete, forged, or inaccurate.

- The scheme is subject to applicant’s eligibility inter-alia under the credit underwriting norms of Avanse Financial Services Ltd.

- This scheme is applicable only for disbursed cases where funds have been remitted by the Company.

- The Company reserves its sole right to make changes in the offer terms and conditions.

- This scheme is subject to review and/or maybe discontinued at any time as per the sole discretion of the Company.