Studying Abroad

The Ticket to Your

Dreams

Moving abroad for your higher education opens several doors. You can gain access to highly-acclaimed and globally recognised programmes, or you may enhance your career prospects for the future. Irrespective of why you’d like to move overseas, there’s no denying that education loans for study abroad can help you achieve all your dreams!

Once you start applying to colleges abroad, you may realise that there’s a lot of paperwork involved in securing an education loan. Study abroad easily when you partner with us for an overseas education loan, you don’t have to do all the study loan for abroad paperwork alone. We’ll be with you at every step of the journey!

What Is a Study Abroad Loan?

When you decide to study abroad, you have to worry about more than just your tuition fees. The cost of living in another country and buying your textbooks all start to add up. Before you even secure your admission, you must prove you have the funds required to pay for your student life abroad. With Avanse educational loans for studying abroad, you don't have to worry about the costs. Our study loans for abroad cover all your education-related costs, right from course fees to travel, books and learning devices. We also offer abroad education loan options without collateral and with collateral. Whatever you need, we’ve got you covered!

When you choose us as your education financing partner, you can rely on us for help with

Score-Based Benefits

As an education-focused organisation, we recognise all the hard work you put into achieving your academic aspirations. We offer preferential interest rates and other special privileges to high merit students applying for our education loan abroad.

Fast-Track Loans

Sometimes, you may need a quick loan to facilitate your admission process. That’s what our fast-track loan for education abroad provides.

Pre-Visa Loan

A pre-visa loan helps students fulfil their financial requirements to qualify for a student visa. At Avanse, we offer pre-visa education loan for study abroad to fulfil their academic aspirations.

Pre-Admission Loans

We’ll sanction a student loan for abroad studies so you can confirm your seat at your preferred university with ease.

Certificate of Availability of Funds

Most universities abroad require you to prove you have the funds to pay for your tuition and living expenses. We’ll provide you with the funds and the certificate to show the availability of funds.

Bridge Loans

Our partnership starts right from when you decide to get an education loan for study abroad in India. Our bridge loans help you with the cost of entrance exam prep and fees, applications, living costs and more!

Who Needs a

Student Loan for

Abroad?

Students with Big Aspirations

Most young people today do not want to live their life with any boundaries or restrictions. They like to question what’s considered normal and hope to pave their own path in life. These young visionaries can benefit the most from our study loan abroad. Enterprising individuals who seek more opportunities can head overseas and gain access to a plethora of educational options.

Students Who Choose to Remain Independent

Moving abroad to study can mean a lot of financial stress on you and your family. Young people today do not want their parents to sacrifice anything for them. Instead, they fund their own education with education loans for studying abroad in India. By doing this, they get to live life on their own terms. With the help of our educational loan for abroad studies, they fund their own education and living expenses.

Students Who Require a Little Assistance

Sometimes, young individuals need a little help with the application paperwork for the course of their dreams. They may also need some financial assistance to take care of their living and other costs. With an education loan in abroad, they can get the help they need without worrying about being a burden on their loved ones.

Study Abroad Education Loan?

If you’re considering an education loan for study abroad, you’ve come to the right place.

Look no further than our Avanse study loan for abroad. Our education loan for abroad studies offers the following benefits:

Network of students

Courses available in universities

Institutes

Loans valid for countries

Ready to let your dreams take flight?

Apply Now

How Do I Apply for an Avanse

Student Loan for Abroad?

Here's how you can get your education loan to study abroad application started:

Fill out the loan for abroad study application

Speak to our educational loan to study abroad consultants

Send us the requisite documents

Receive the student loans for studying abroad amount

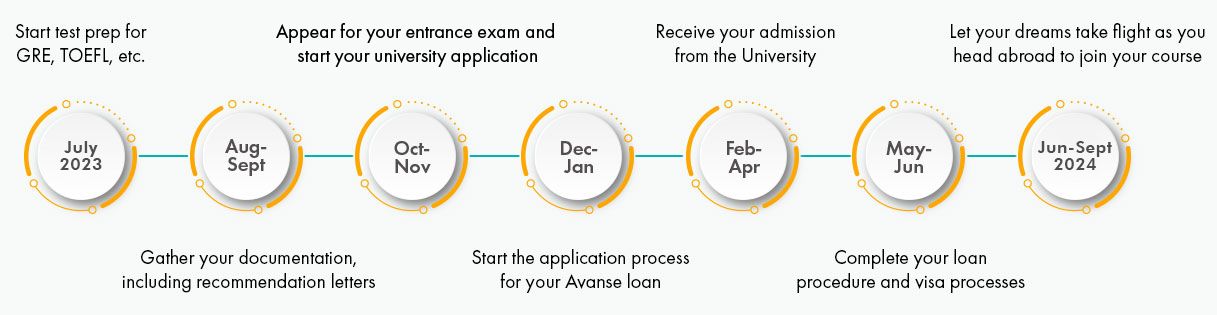

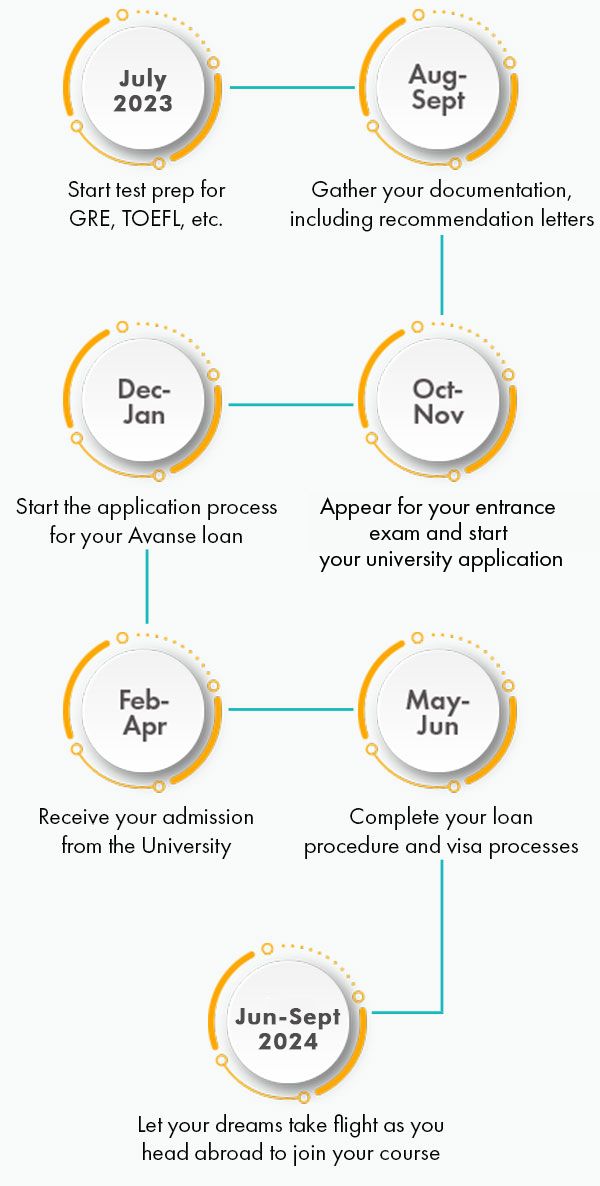

When Is the Right Time to Apply for a

Loan for Overseas Education?

Most Indian students hope to join their preferred course abroad

between June and September each year.

If you’re one of

them, here’s a look at when you need to start the application

process

Understanding Your

Loan for

Higher Education Abroad

Who can apply for a student loan to study abroad?

Students can apply if they:

- Are Indian citizens who are 18 or older

- Have a confirmed admission before the final disbursal

- Have a co-borrower who earns in India

Co-borrowers also need to meet the following criteria:

- Must be an Indian citizen and should be a parent, legal guardian, sibling or other blood relative

- Must have a bank account in India that allows them to sign cheques

- Must be the primary debtor

Students can apply for a foreign education loan for graduate or post-graduate courses or other job-oriented professional or technical courses. The courses and the institute offering them must be approved by Avanse.

To complete your application for a student loan for abroad, you will have to provide the following documents:

- Student KYC and educational documents

- Details regarding the course and fees

- Co-borrower KYC and income details

- Collateral documents

Here are the list of documents required for education loan for abroad studies

| Documents | Applicant | Co-Applicant | Additional Co-Applicant | Guarantor |

|---|---|---|---|---|

| 2 Colour Passport-sized Photos | ||||

| Photo ID | ||||

| Residence Proof | ||||

| Date of Birth Proof | ||||

| Signature Verification | ||||

| Academic Documents | ||||

| Proof of Admission | ||||

| Fee Structure | ||||

| Income Proof | ||||

| Collateral Documents | ||||

| 8-month Bank Statement | ||||

| Relationship Proof |

At Avanse, we offer the best education loans to study abroad and we don’t want to limit your dreams. While the minimum loan amount for an overseas study loan is INR 1,00,000, we do not put a cap on the maximum loan amount. We strive to create customised education loans in India for studying abroad that meet all your financial needs with ease. Additionally, we will not ask for any margin contribution. Our goal is to provide holistic funding for your education so you can achieve your academic aspirations successfully.

Our overseas education loan will cover

- Up to 100% of the tuition fee as decided by the university or institute

- Up to 75% of your living expenses, including the purchase of books, computers and other equipment, as long as it does not exceed 20% of the tuition fee

- Up to 100% of the building fund or caution deposit or refundable deposit as long as it does not exceed 10% of the tuition fee and comes with valid bills or receipts from the institution

- Travel expenses or passage money up to INR 75,000 for the student travelling abroad

When you choose Avanse as your education financing partner, you can count on quick, transparent and completely hassle-free loans. To apply for an education loan to study abroad, you can fill up the online form or send an e-mail to wecare@avanse.com. For a smooth application journey, you should inform us about:

- The amount of financial assistance required

- The course and institute where you intend to study

- The identity of your co-applicant or guarantor

Ideally, check which documents you need to submit and apply for the loan well in advance to avoid last-minute hassles.

Once we receive the application, our consultants will review it and get in touch with you if they require any additional information. If your application checks all our boxes, we will provide you with a formal Loan Offer letter. Here, we outline the loan amount you can get as well as a list of documents we require from you. You may use the loan offer letter to secure your seat at your preferred university or institute.

Once all the paperwork is ready, we will provide you with an education loan agreement. The agreement lists out all the terms and conditions. After you review the paperwork and sign it, we will disburse the loan amount via DD, cheque or electronic transfer.

Avanse provides secured educational loans for studying abroad.

The collateral we

accept as security includes:

- Residential property (apartment/house)

- Fixed deposit by any registered deposit-taking organisation, assigned in favour of Avanse

- Life insurance with a surrender value equal to the required security coverage

- Non-agricultural land

Take a look at how the loan amount gets disbursed to ensure you’re making an informed decision:

- The education loan for studying abroad amount will be disbursed in Indian Rupees.

- Tuition and hostel fees will be sent directly to the institute or university as per the agreed-upon schedule of payments.

- The loan amount for other expenses will get transferred to the co-borrower’s account in instalments over the duration of the course.

- When the student chooses to reside outside the hostel, the money gets transferred directly to the co-borrower’s account.

- Whenever required, money will be transferred with a third-party FOREX vendor as per the agreement.

Generally, Avanse charges 1-2% of the loan amount as the processing fee. However, we evaluate the amount on a case-to-case basis and share the final amount while processing the loan.

To ensure you always enjoy a competitive rate of interest, we work with floating rates. We calculate the interest on your loan using the formula: Interest = Avanse Base Rate + Spread. Our base rate is currently static at 14.25% (WEF 01.05.2023). The spread changes periodically based on your overall credit and course profiling. We use a simple interest rate with monthly rest to calculate the rate of interest on your education loan.

At Avanse, we believe in being transparent. We want you to have all the information required, so here’s a look at our service charges:

| Description of Charges | Charges and Fees |

|---|---|

| Pre-payment charges | No pre-payment allowed within 6 months from the disbursal of the loan |

| Charges for late payment of PMII/EMI | 2% per month |

| Cheque/ECS bounce charges (per bounce) | INR 500/- plus applicable GST |

| Document handling charges (during foreclosure) | INR 2,000/- onwards plus applicable GST |

Additional services, as required, will be charged at a nominal fee as per Avanse policy.

You can choose a repayment tenure that suits your needs as long as it falls within the following limits:

Minimum loan repayment tenure – 12 months

Maximum loan repayment tenure – 180 months (including the course duration)

We also offer a grace period of 6 months from the time you complete the course or a grace period of 3 months from the time you secure your first job.

Our loans are designed to help you meet all your financial needs. So, we provide multiple repayment options. You can start repaying from the time you’re in college or once you complete the course and secure a job. While repaying, you can choose between:

- Interest servicing during the course

- Partial interest servicing during the course

- EMI repayment during the course

- EMI repayment after a holiday/moratorium period

- Step up repayment facility

Still need some more information about your education loan for abroad studies? Get our document checklists and more:

It’s okay to have questions, because we’ve got answers!

Yes, you can apply for an education loan to study abroad. Indian lenders have a list of approved countries, colleges and courses. They will issue loans if you have a confirmed seat for a recognised course at a reputed college and if you meet their eligibility criteria.

To apply for an education loan for abroad studies, you must be an Indian citizen over the age of 18, have a co-borrower who earns in India, and confirmed admission to the institution. Additionally, your co-borrower must be an Indian citizen who could be a parent, sibling, other blood relative or legal guardian. They should be the primary debtor and have a bank account in India that allows them to sign cheques.

While applying for a loan to study abroad, you need to provide course and fee details, your KYC and educational documents, your co-borrower’s KYC and income details, collateral documents in case of a secured loan and other relevant documents required by your financial institution. The type of document

To get a student loan for the USA from India, you must meet the eligibility criteria. You must have secured admission, be an Indian citizen over 18, and have a co-borrower earning in India.

The loan amount depends on your course fee and the potential costs of living abroad. You can use an online education loan expense calculator to understand how much you will likely require to manage comfortably.

Yes, you can get loans for abroad education without collateral. Before approaching a lender, you must decide whether you want a secured or unsecured study loan for abroad. You may offer your residential property or non-agricultural land as collateral for your loan. Lenders will evaluate the documents required and provide a loan amount and education loan rate of interest.

If you don’t have anything to offer as security, don’t worry! You can opt for an education loan without collateral. When you partner with Avanse, you can get an education loan for abroad studies without collateral. We believe every student deserves a chance to access the world’s best education. After evaluating your previous academic records and your family’s financial history, we will offer you a student loan for abroad courses without asking for security.

Opting for an abroad education loan without collateral may impact your loan amount and interest rate. You can use an online education loan eligibility calculator to understand the maximum loan amount you could get without collateral.

Every young Indian deserves the chance to follow their dream of studying abroad. At Avanse, we help level the playing field. With our education loan for studying abroad, you can move overseas to fulfil your academic aspirations. At Avanse, we are proud to provide a student-friendly education loan interest rate for abroad study to help you achieve all your dreams. When applying, you must check the abroad education loan eligibility criteria to avoid unnecessary rejection.

Understanding the student loan for study abroad age criteria and other minimum requirements can make the application process quick and easy. Let's look at the Avanse eligibility criteria for an overseas education loan.

Students can apply if they:

- Are Indian citizens who are 18 or older

- Have a confirmed admission before the final disbursal

- Have a co-borrower who earns in India

Co-borrowers also need to meet the following eligibility criteria:

- Be an Indian citizen and should be a parent, legal guardian, sibling or other blood relative

- Have a bank account in India that allows them to sign cheques

- Be the primary debtor

Students can apply for a foreign education loan for graduate or post-graduate courses or other job-oriented professional or technical courses. Avanse must approve the courses and the institutes offering them.

Read about the success stories of students who have achieved their educational aspiration.

MBA in IT in the USA: An interesting guide

An MBA in Information Technology (IT) is a unique combination of two disciplines - Management and Technology. Several students enrol in MBA in IT programs at well-ranked ...

What aspirants must know before pursuing a PhD in Europe

A Doctor of Philosophy or PhD is an advanced academic degree that combines theoretical knowledge and research. Students prefer pursuing this degree from European universi...

Cost of living in Ireland for international students: 2024

An excellent education system, student-friendly visa policies, and a welcoming environment make Ireland an incredible study abroad destination. If you are planning to pur...

In-demand jobs in Ireland you must know

Ireland is a popular educational hub that offers world-class education to students. Moreover, Ireland’s job market is promising and offers a plethora of work opportunitie...

How to draft an engaging SOP for MS in Computer Science

Most international universities offering Master of Science (MS) in Computer Science (CS) require a well-written Statement of Purpose (SOP), which is a part of the admissi...